Zero coupon bond yield to maturity calculator 778066-Coupon bond yield to maturity calculator

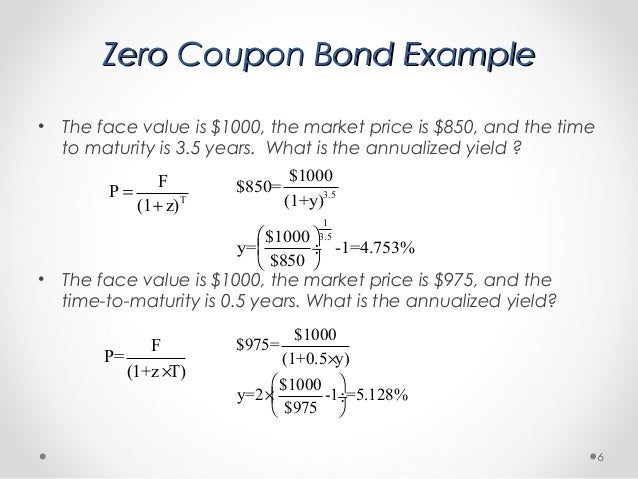

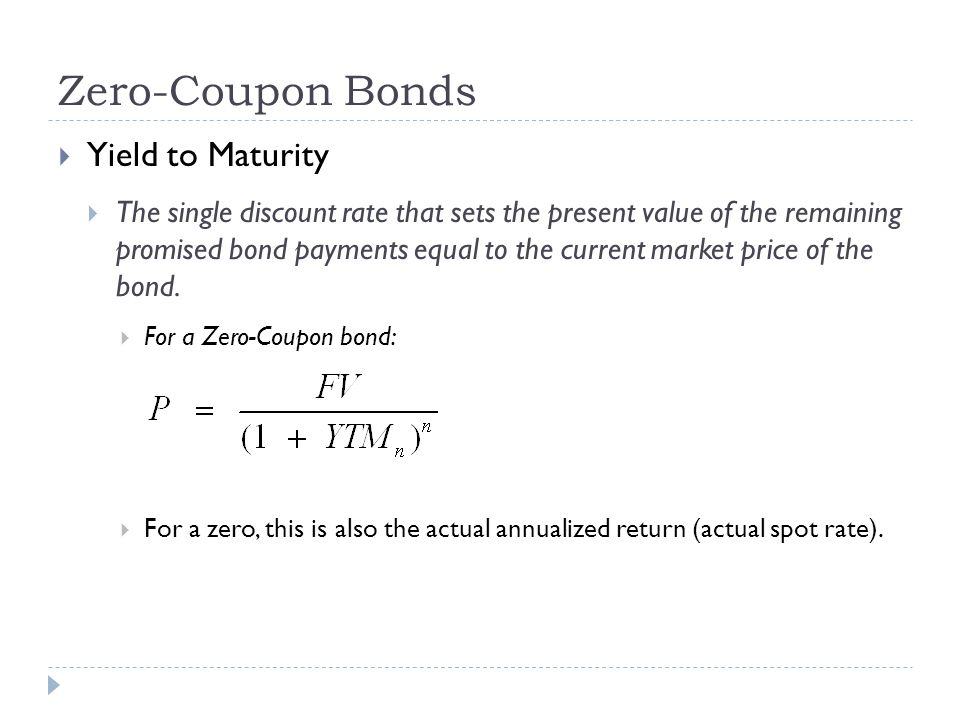

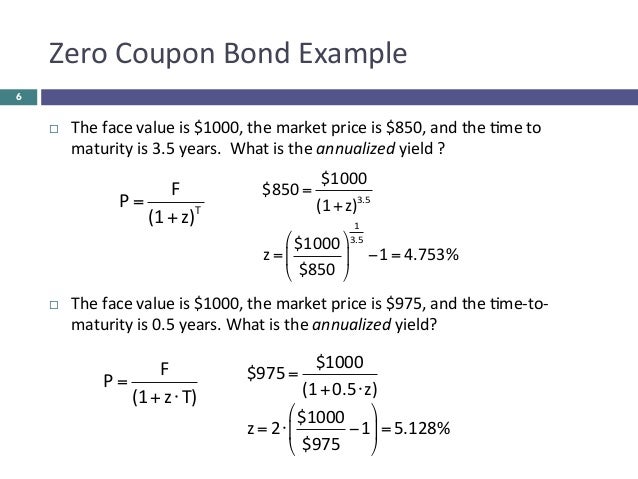

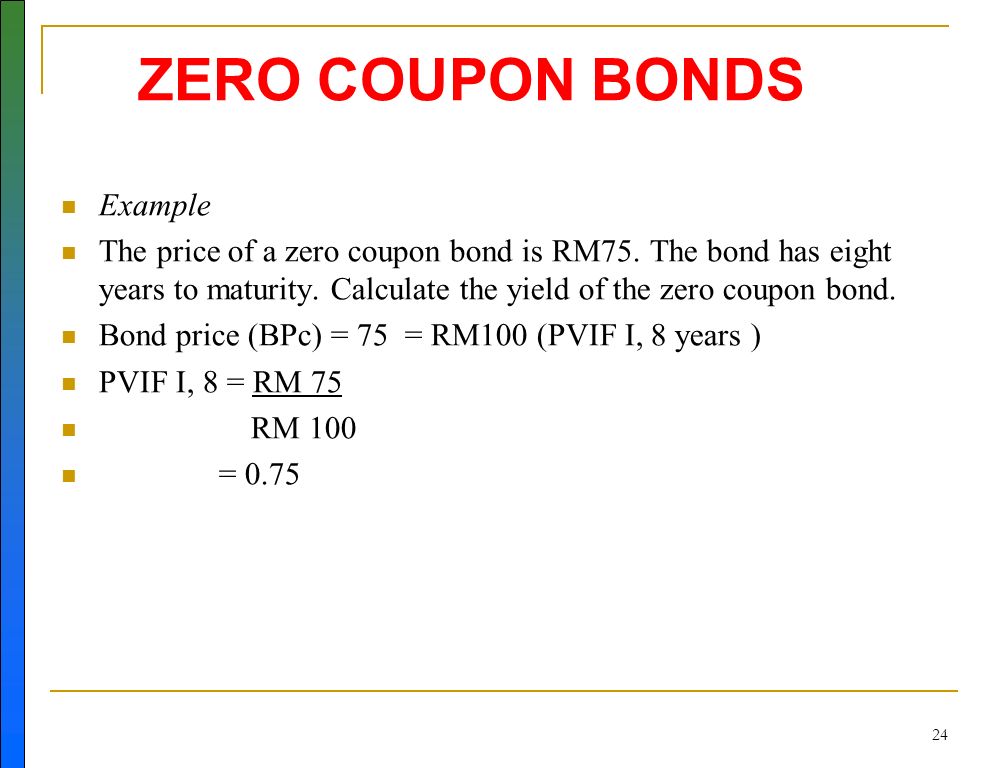

Zero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bondZero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) The face or par value of the bond – essentially, the value of the bond on its maturity date Annual Interest Rate (%) The interest rate paid on the zero coupon bond Years to Maturity The numbers of years until the zero coupon bond's maturity dateIt is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses

How To Calculate Bond Price In Excel

Coupon bond yield to maturity calculator

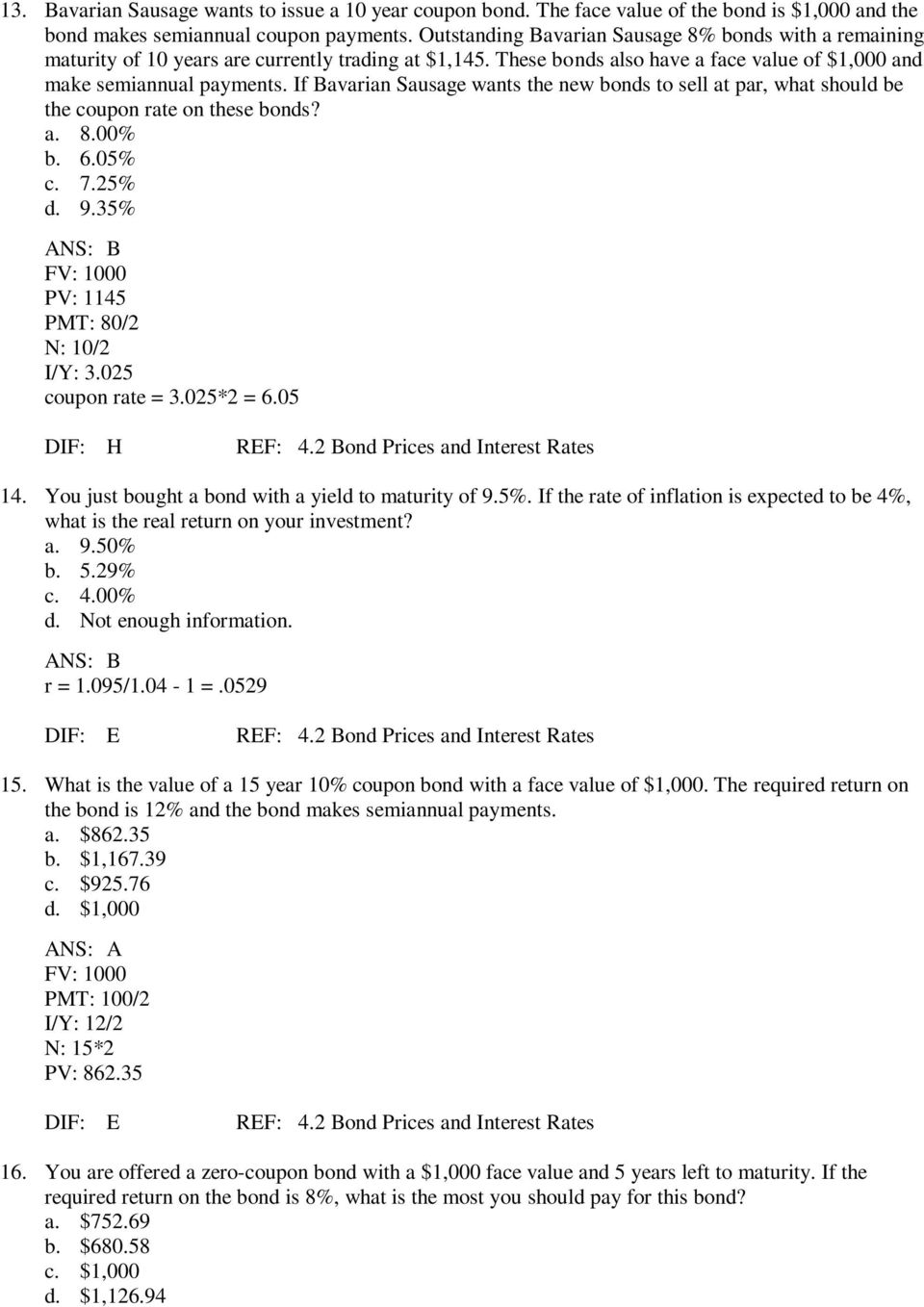

Coupon bond yield to maturity calculator-The coupon payments are made semiannually, and the required yield is 12% per annum Bond Pricing Semiannual Interest payment 24 Bond Pricing zero coupon bonds No periodic coupon payments Single payment of par value at maturity The price of bond (PB) is simply the present value (PV) of the face value (F) (ie, the face value discounted atZero Coupon Bond Yield To Maturity Calculator 12Nov CODES (1 months ago) You can get a high discount of 85%The new discounts are available at CouponMount, and the most recent discounts are out on today 6 latest Zero Coupon Bond Yield To Maturity Calculator results have been discovered in the last 90days, which means every new result

The Yield To Maturity On One Year Zero Coupon Bonds Is 8 2 The Yield To Maturity On Two Year Zero Coupon Bonds Is 9 2 A What Is The Forward Rate Of Interest For The Second Year

Yield to maturity Wikipedia (1 months ago) Finally, a oneyear zerocoupon bond of $105 and with a yield to maturity of 556%, calculates at a price of 105 / ^1 or 9947 Couponbearing Bonds For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraicallyTo calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900Yield To Maturity Zero Coupon Bond Calculator CODES (5 days ago) (4 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get Subtract 1, and you have , which is %

Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10 Pmt = The payment made in every period It cannot change over the life of the bond The coupon rate is 6% But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%Zero Coupon Bond Value Calculator Calculate Price, Yield (6 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get1a Calculate the yield to maturity (ie, YTM) for the following bond The bond matures in 28 years, has a coupon rate of 67% with semiannual payments The par value of the bond is $1000, while the current market value equals $934 (Round to 100th of a percent and enter your answer as a percentage, eg, 1234 for 1234%) Answer 1b

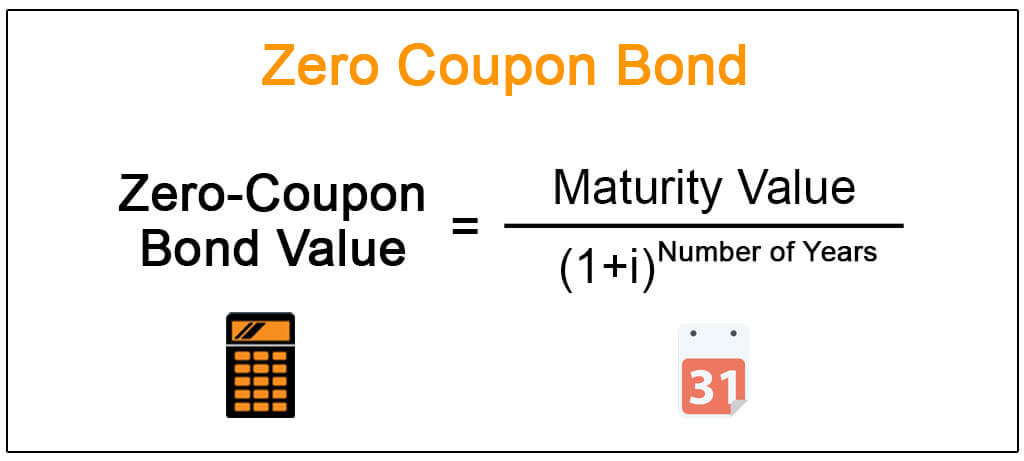

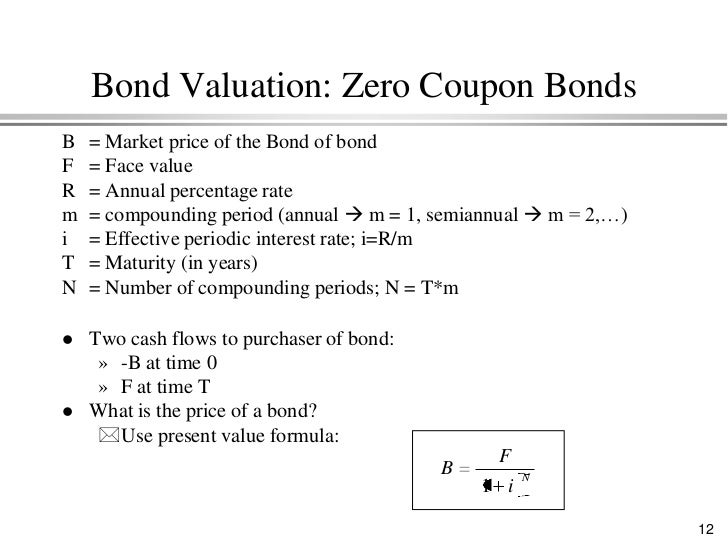

The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds atThe calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Bond Duration Calculator Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present ValueZeroCoupon Bond A zerocoupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

The Yield To Maturity On One Year Zero Coupon Bonds Is 8 2 The Yield To Maturity On Two Year Zero Coupon Bonds Is 9 2 A What Is The Forward Rate Of Interest For The Second Year

(1 months ago) Zero Coupon Bond Yield Formula (with Calculator) CODES (3 days ago) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get Subtract 1, and you have , which is %A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity That definition assumes a positive time value of moneyIt does not make periodic interest payments or have socalled coupons, hence the term zero coupon bond When the bond reaches maturity, its investor receives its par (or face) value

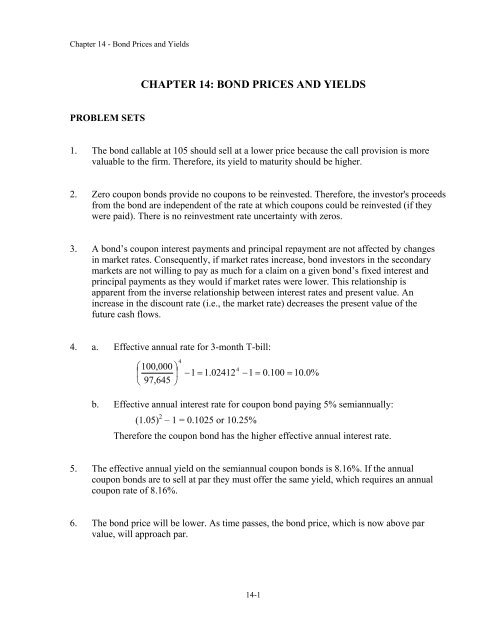

Chapter 14 Bond Prices And Yields To Maturity

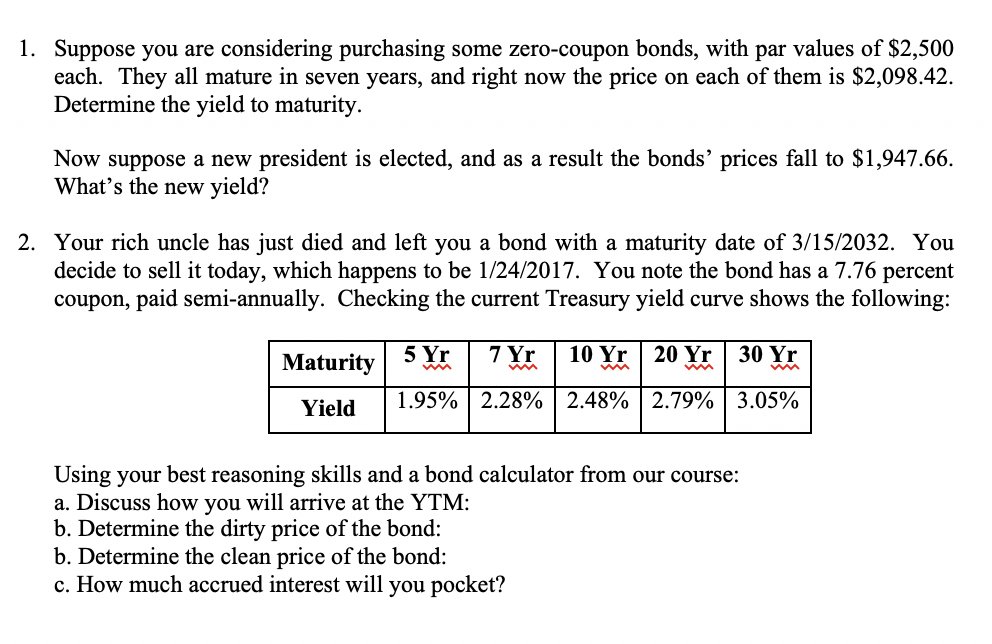

Solved 1 Suppose You Are Considering Purchasing Some Zer Chegg Com

The Zero Coupon Bond Calculator is used to calculate the zerocoupon bond value Zero Coupon Bond Definition A zerocoupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturityZeroCoupon Bond A zerocoupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its fullThus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $ The difference between the current price of the bond, ie, $, and its Face Value, ie, $1000, is the amount of compound interest that will be earned over the 10year life of the Bond

Q Tbn And9gcsp25zjynanfjklb7g 0opdrwusuwkhwdwzqpddk9o Usqp Cau

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Zero Coupon Bond Value Calculator Calculate Price, Yield (6 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you getThus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $ The difference between the current price of the bond, ie, $, and its Face Value, ie, $1000, is the amount of compound interest that will be earned over the 10year life of the BondZero coupon bond yield is calculated by using the present value equation and solving it for the discount rate The resulting rate is the yield It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond The zero coupon bond yield helps investors decide whether to invest in bonds

Bond Yield To Call Ytc Calculator

Bond Equivalent Yield Formula Calculator Excel Template

Bond Yield to Maturity (YTM) Calculator DQYDJ (2 days ago) Yield to Maturity of Zero Coupon Bonds A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value) This makes calculating the yield to maturity of a zero coupon bond straightforwardBelow you will find Zero Coupon Bond Yield Calculator, that will help you calculate Zero coupon bond yield Zero coupon bonds do not have coupon payment schemes and are traded in a discount rate which when redeemed at the Face values, leads to the lump sum profits made by the owners at the end of the maturity periodHow to detect whether Zero Coupon Bond Yield To Maturity Calculator results are verified or not?

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Fcondemand Fixed Income Investing

Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond The calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2Zero Coupon Bond Yield Calculator YTM of a discount bond CODES (3 days ago) Zero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bondAs per the CouponMound's tracking system, it offers 17 search results of Zero Coupon Bond Yield To Maturity Calculator Coupons for Zero Coupon Bond Yield To Maturity Calculator with verified labels work for most purchases

Solved Problem 6 1 We Are Given The Following Yield Curve Chegg Com

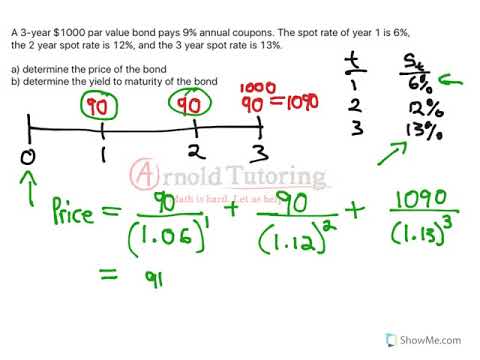

Bonds Spot Rates Vs Yield To Maturity Youtube

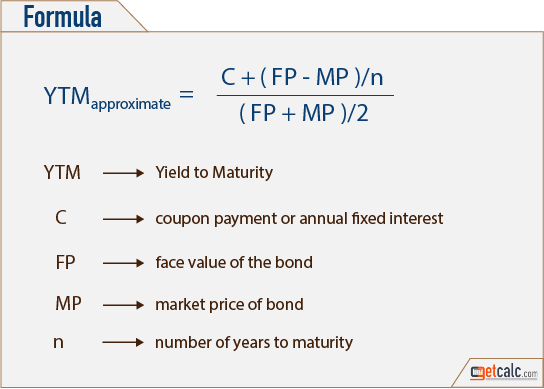

How to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturityNper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10 Pmt = The payment made in every period It cannot change over the life of the bond The coupon rate is 6% But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables C = 1000*008 = 80

Calculate Zero Coupon Bond Valuation Valuation Calculator

Zero Coupon Interest Calculator

Current Yield = (Face Value * Coupon Rate / 100) / Current Value Yield to Maturity is calculated using a Javascript implementation of the Excel RATE function Related Calculators Bond Convexity Calculator Bond Duration Calculator Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value Calculator Zero Coupon Bond Value CalculatorThe Zero Coupon Bond Calculator is used to calculate the zerocoupon bond value Zero Coupon Bond Definition A zerocoupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity It does not make periodic interest paymentsThe holder of a zero coupon bond expects a return upon the bond's maturity (a higher price than the initial purchase price) The yield to maturity (YTM) is the return the bondholder expects to receive and is calculated using the bond's face value, its current price and the number of years until maturity

Coupon Two Coupon Yield

Yields To Maturity On Zero Coupon Ronds Bond Math

Yield To Maturity Zero Coupon Bond Calculator CODES (5 days ago) (4 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get Subtract 1, and you have , which is %Zero Coupon Bond Effective Yield = ((Face Value of Bond / Present Value of Bond) ^ (1 / Period)) – 1 The process of solution we need to use is Zero Coupon Bond Effective Yield = ((1000 / 700) ^ (1 / 5)) – 1The holder of a zero coupon bond expects a return upon the bond's maturity (a higher price than the initial purchase price) The yield to maturity (YTM) is the return the bondholder expects to receive and is calculated using the bond's face value, its current price and the number of years until maturity

Coupon Two Coupon Yield

Calculating The Yield Of A Coupon Bond Using Excel Youtube

Zero Coupon Bond Yield Calculator YTM of a discount bond CODES (4 days ago) Zero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bondSemi Annual Coupon Rate Calculator CODES (2 days ago) Semi Annual Coupon Payment Calculator CODES (7 days ago) COUPON (2 days ago) (3 months ago) Calculate the price of a sixyear $1,000 facevalue bond with a 7% annual coupon rate and a yieldtomaturity of 6% with semiannual coupon payments $1,050 A tenyear $10,000 facevalue bond with semiannual coupon payments has an 8% annual couponThe formula for calculating the yield to maturity on a zerocoupon bond is Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Consider a $1,000 zerocoupon bond that has

Calculate Zero Coupon Bond Valuation Valuation Calculator

Solved Chapter 7 Problem Set Students Must Show Work To Receive Full Credit Compute The Price Of A 9 Coupon Bond With Years To Maturity And A Course Hero

A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity That definition assumes a positive time value of moneyIt does not make periodic interest payments or have socalled coupons, hence the term zero coupon bond When the bond reaches maturity, its investor receives its par (or face) valueIt is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or lossesYield To Maturity Zero Coupon Bond Calculator CODES (9 days ago) Zero Coupon Yield To Maturity Calculator, 0221 CODES (3 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get

Bond Formula How To Calculate A Bond Examples With Excel Template

Chapter 10 Bond Prices And Yields Pdf Free Download

The holder of a zero coupon bond expects a return upon the bond's maturity (a higher price than the initial purchase price) The yield to maturity (YTM) is the return the bondholder expects to receive and is calculated using the bond's face value, its current price and the number of years until maturitySemi Annual Coupon Rate Calculator CODES (2 days ago) Semi Annual Coupon Payment Calculator CODES (7 days ago) COUPON (2 days ago) (3 months ago) Calculate the price of a sixyear $1,000 facevalue bond with a 7% annual coupon rate and a yieldtomaturity of 6% with semiannual coupon payments $1,050 A tenyear $10,000 facevalue bond with semiannual coupon payments has an 8% annual couponIt is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Yield to Maturity of Zero Coupon Bonds A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value) This makes calculating the yield to maturity of a zero coupon bond straightforwardThis video demonstrates how to calculate the yieldtomaturity of a zerocoupon bond It also provides a formula that can be used to calculate the YTM of anComputational Notes See Bond Calculator Macaulay Duration, Modified Macaulay Duration, Convexity for computational procedures used by the calculator Related Calculators Bond Convexity Calculator Bond Present Value Calculator Bond Yield to Maturity Calculator Zero Coupon Bond Value Calculator

/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Calculating Yield To Maturity Of A Zero Coupon Bond

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

Q Tbn And9gcsino 0g4j4abcfdbc09bh1lusrg0 Zbznmqfuhlv Gyae8xqig Usqp Cau

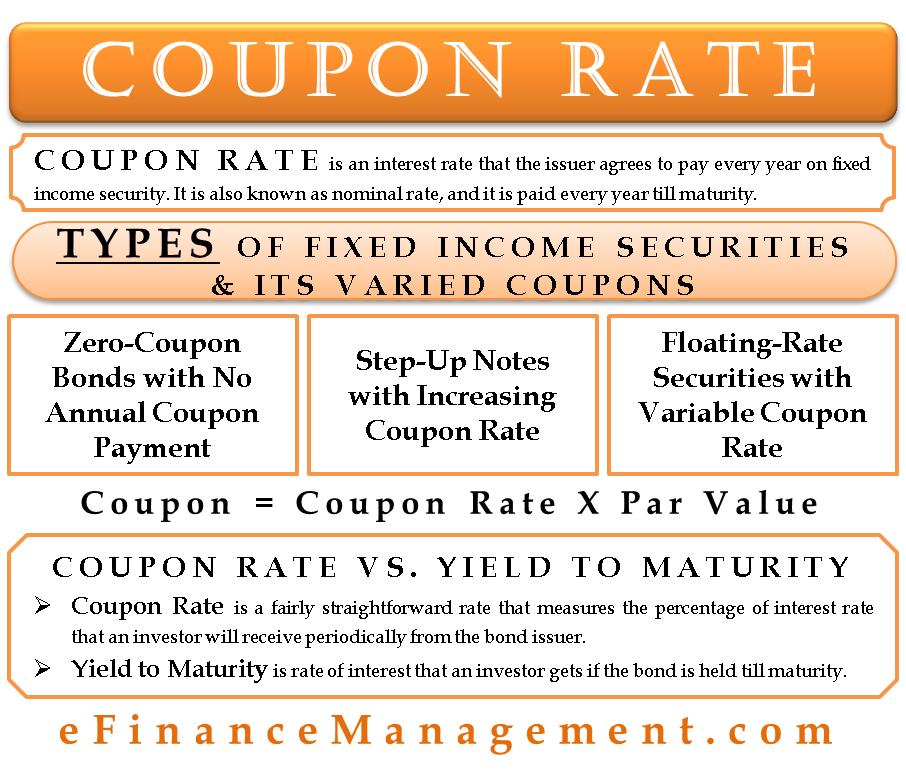

Coupon Rate Meaning Example Types Yield To Maturity Comparision

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

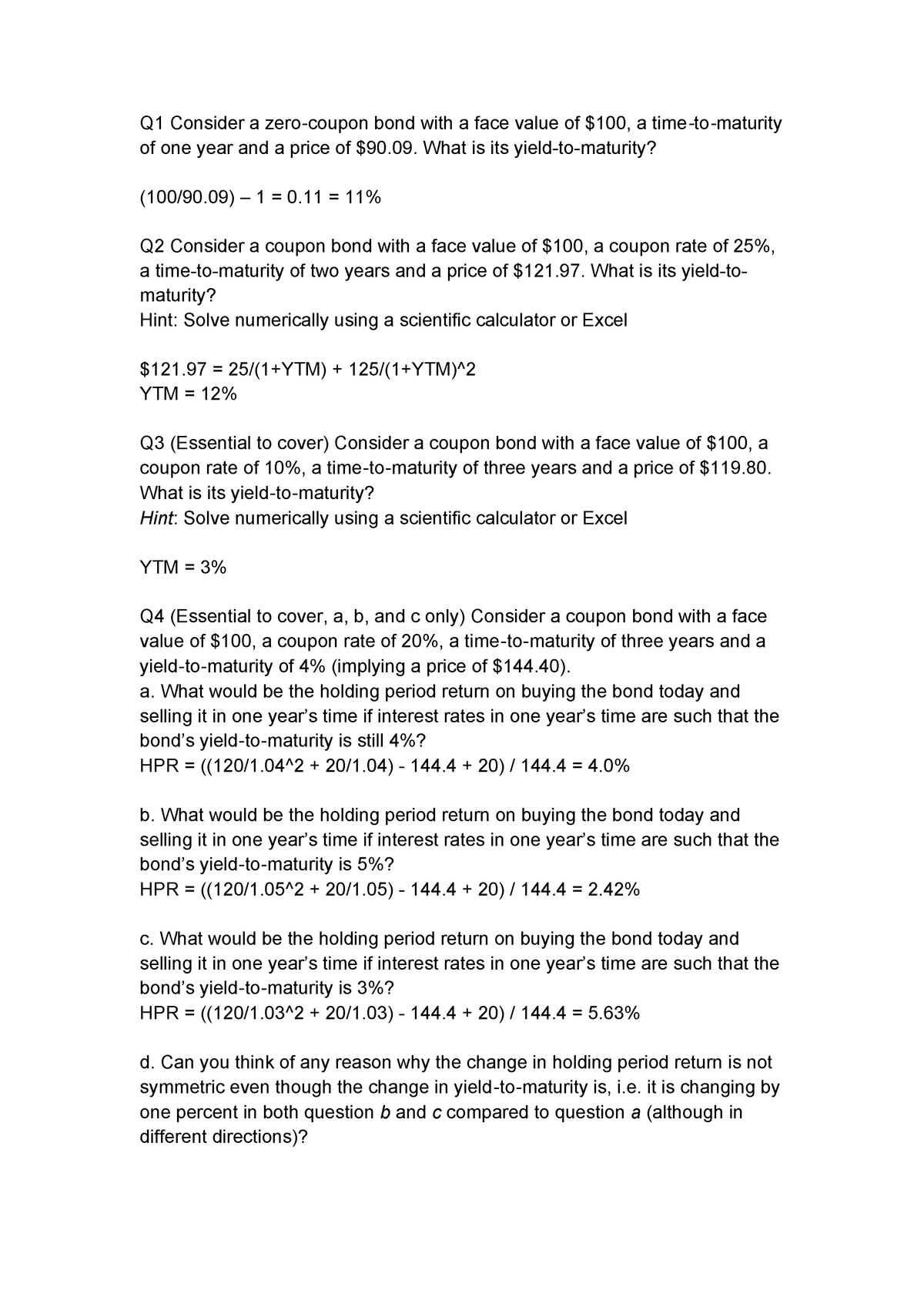

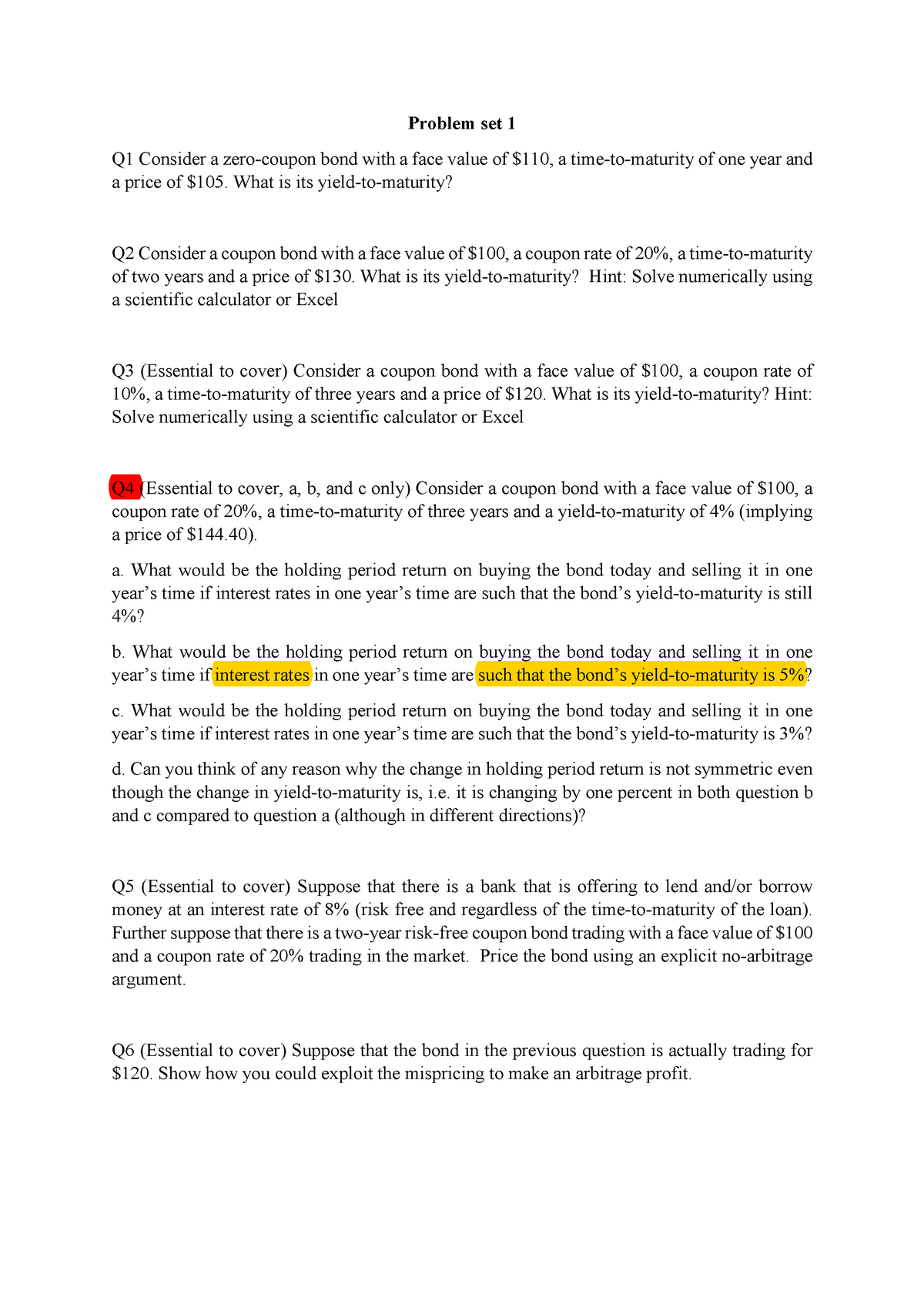

Problem Set 1 Tutorial Question Studocu

Face Term Coupon Rate Value Zero Coupon Yield R 0 Chegg Com

Zero Coupon Bond Definition Formula Examples Calculations

Mgt338 Chapter 6 Valuing Bonds Team Study

Zero Coupon Bond Value Calculator Calculate Price Yield To Maturity Imputed Interest For A Zero Coupon Bonds

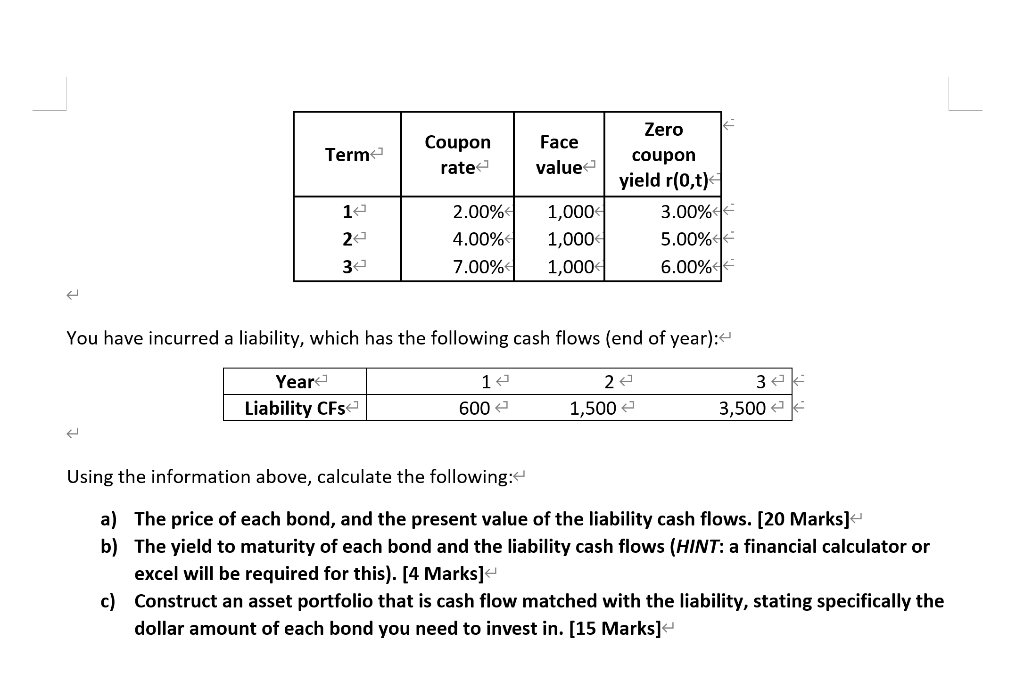

Solved Assume A Zero Coupon Bond That Sells For 717 Will Chegg Com

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Calculate Zero Coupon Bond Valuation Valuation Calculator

Zero Coupon Bond Yield Calculator Find Formula Example More

Modified Duration

Duration And Convexity With Illustrations And Formulas

Bonds Yields And Yield To Maturity Economics Online

How To Calculate Bond Price In Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube

Alexander Nunez Torres Phd Ppt Download

Computing Risk Free Rates And Excess Returns From Zero Coupon Bonds Refinitiv Developers

How To Calculate Bond Price In Excel

Q Tbn And9gcspuy9giugvfcvueflrzidtvhlsn9e5eqcnannn Rbj6l5qub Usqp Cau

Http Burcuesmer Com Wp Content Uploads 15 10 Bond Valuation Pdf

%201.jpg)

Bond Valuation

Stand What You Are Calculating That You Know Whether Your Calculator Assumes Course Hero

Calculating And Using Implied Spot Zero Coupon Rates Bond Math

Bond Yield To Maturity Calculator For Comparing Bonds

Bond Yield To Maturity Ytm Calculator

Print Pack And Ship With Fedex Office

Calculate The Ytm Of A Coupon Bond Youtube

Bond Yield To Maturity Ytm Calculator

Zero Coupon Bond Valuation Using Excel Youtube

Calculating Yield To Maturity Of A Zero Coupon Bond

1

Zero Coupon Bond Value Calculator Calculate Price Yield To Maturity Imputed Interest For A Zero Coupon Bonds

Yield To Maturity Calculator Zero Coupon Bond

16 2 Bond Value Personal Finance

Bond Yield Formula Calculator Example With Excel Template

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Yield To Maturity Ytm Calculator

Please Explain How To Calculate In A Financial Calculator Question 2 Mtv Corporation Has 7 Percent Coupon Bonds On Homeworklib

Bond Yield To Maturity Ytm Calculator

Problem Set 1 Fins2624 Portfolio Management Studocu

Bond Yield Calculator

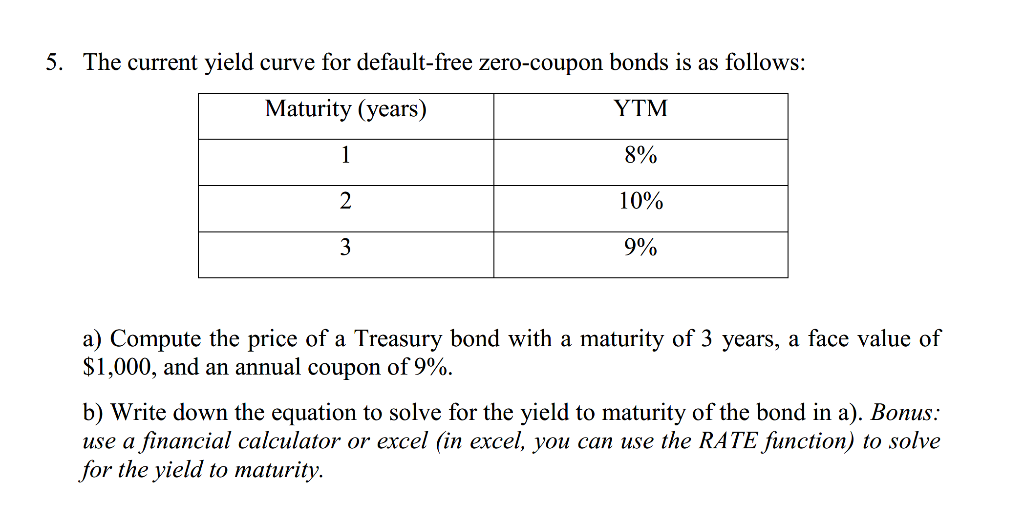

Solved 5 The Current Yield Curve For Default Free Zero C Chegg Com

What Is Zero Coupon Bond Example

The Yield To Maturity On 1 Year Zero Coupon Bonds Is Currently 6 5 The Ytm On 2 Year Zeros Homeworklib

Learn To Calculate Yield To Maturity In Ms Excel

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Zero Coupon Bond Yield Formula With Calculator

Solved Problem Set 2 Qi Consider A Zero Coupon Bond With Chegg Com

Zero Coupon Bond Definition Formula Examples Calculations

Berk Chapter 8 Valuing Bonds

Frm Ti Ba Ii To Compute Bond Price Given Zero Spot Rate Curve Youtube

What Is A Zero Coupon Bond Who Should Invest Scripbox

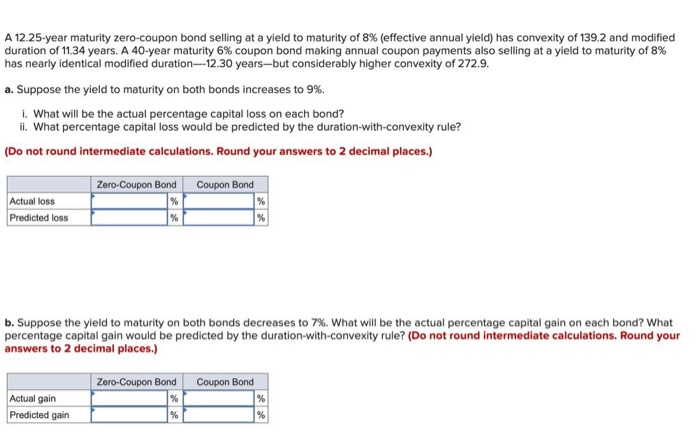

Solved A 12 25 Year Maturity Zero Coupon Bond Selling At Chegg Com

Bond Pricing And Accrued Interest Illustrated With Examples

Calculate The Ytm Of A Zero Coupon Bond Youtube

Yield To Maturity Ytm Calculator

A 12 25 Year Maturity Zero Coupon Bond Selling At A Yield To Maturity Of 8 Effective Annual Yield Homeworklib

Vba To Calculate Yield To Maturity Of A Bond

Rwjchapter7problemsolutions

Calculating The Yield Of A Zero Coupon Bond Youtube

Zero Coupon Bond Calculator Calculator Academy

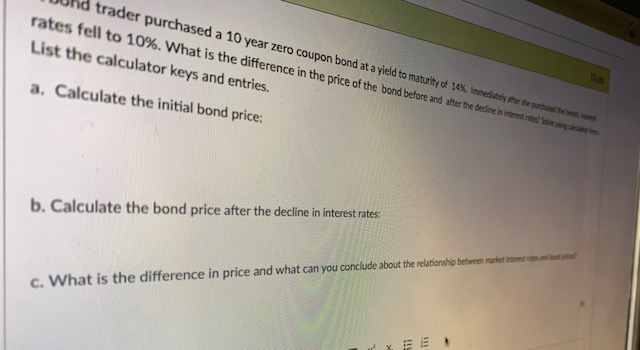

Solved Trader Purchased A 10 Year Zero Coupon Bond At A Y Chegg Com

Zero Coupon Bond

Please Show How To Calculate With Financial Calculator Question 3 Jones Corporation Has Zero Coupon Bonds On The M Homeworklib

Zero Coupon Bond

Bond Convexity Calculator Estimate A Bond S Yield Sensitivity Dqydj

What Is A Zero Coupon Bond Who Should Invest Scripbox

Finding Bond Price And Ytm On A Financial Calculator Youtube

21 Cfa Level I Exam Cfa Study Preparation

Chapter 6 Bonds 6 1 Chapter Outline 6 1 Bond Terminology 6 2 Zero Coupon Bonds 6 3 Coupon Bonds 6 4 Why Bond Prices Change 6 5 Corporate Bonds Ppt Download

How Do I Calculate Yield To Maturity Of A Zero Coupon Bond

How To Calculate Pv Of A Different Bond Type With Excel

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

コメント

コメントを投稿